Although the Fixed Assets module has been around since Navision’s days, its capabilities are some of the most underutilised in the entire Business Central suite

1️⃣ FA Data Migration

Often, only fixed assets with book value are considered for data migration, while those fully depreciated (but still active) are left out.

Best Practice: Import all your Fixed Assets that are still owned by the organisation so that you can sell them, register maintenance costs, or even appreciate them through a CAPEX investment later.

2️⃣ Low-Cost Assets

The general practice is to expense low-value assets directly—for example, a phone under $1000 (or whatever the capitalisation threshold is under the local legislation).

Best Practice: Create it as a Fixed Asset under a Low-Value depreciation book and use a one-month depreciation period to expense it when the asset starts to be utilised. This way, the low-value asset will not be misplaced, and there will be a trace of where it is and who uses it.

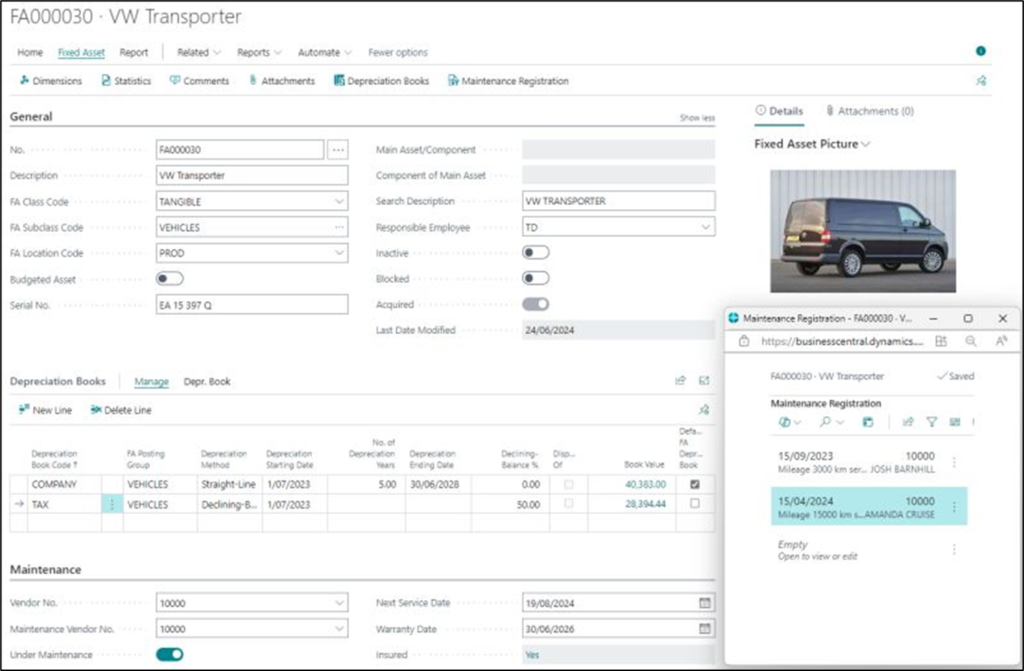

3️⃣ Maitenance Costs

I have rarely seen maintenance costs registered against Fixed Assets, most likely because operating expenses do not impact the book value.

Best Practice: Use maintenance capabilities to track the next service date, warranty date, and who is providing maintenance. Additionally, track expenses related to fixed assets via FA journals (FA Posting Type = Maintenance) so you know how much it costs to maintain them—you might find it cheaper to replace them.

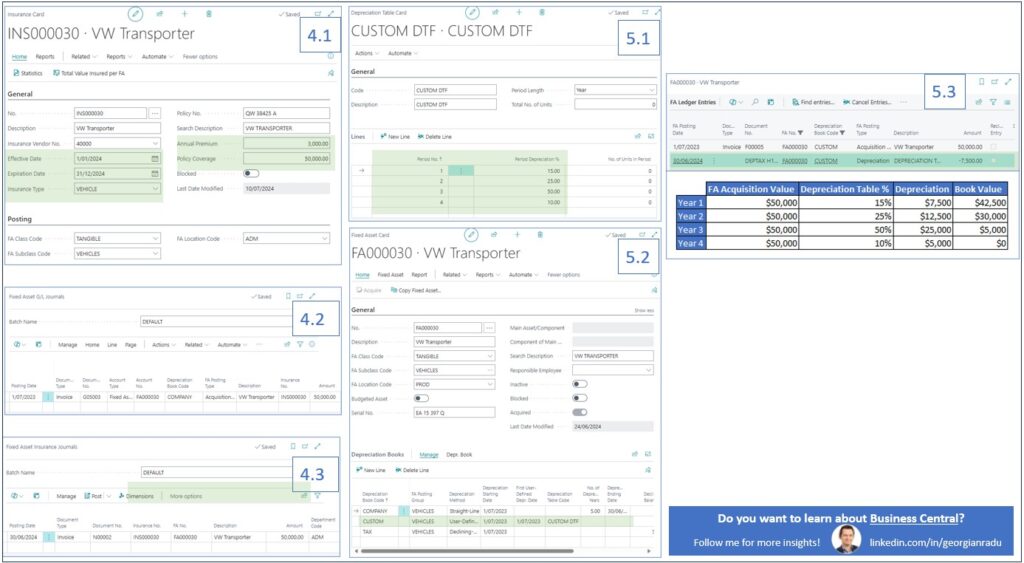

4️⃣ Fixed Assets Insurance

A basic principle of internal control is protection of the organisation assets and with Business Central you have the peace of mind your business is protected.

Best Practice:

1️⃣ Create an Insurance Card – one policy could cover one or more fixed assets

2️⃣ Link the FA with the insurance policy via FA Journal or via the Purchase Document – as part of the FA aquisition

3️⃣ If the FA was already aquired, use Fixed Assets Insurance Journal to link the FA to the insurance

Tip: Use Insurance Journals to correct the insurance policy or FA allocation

5️⃣ User Defined Depreciation Method

If none of the other depreciation options meet business needs, the User Defined depreciation method offers complete flexibility to define a custom depreciation logic.

Best Practice:

1️⃣ Create a Depreciation Table and define custom depreciation rules

2️⃣ Use User Defined as depreciation method

3️⃣ Calculated depreciation follows the custom rules as per the Depreciatian Table

Tip: While the first entry in FA ledger entries must be an aquisition, by setting the depreciation start date at an earlier date, depreciation will be calculated for the entire period between depreciation start date and depreciation calculation date.

These practices will boost FA data management insights, which is critical for small organisations with no other means of tracking their assets.

As a general rule, always use Business Central to the fullest and keep your product knowledge up to date with what’s coming in the new releases.