Foreign currencies, exchange rates, currency exchange risks, realised and unrealised gains & losses? Sounds daunting! Don’t worry, Business Central has your business back.

The world is one interconnected global market, buying or selling products and services is no longer limited to the local market.

More and more businesses must operate with foreign currencies and manage the exchange rate risks.

𝑆𝑐𝑒𝑛𝑎𝑟𝑖𝑜: 𝑡ℎ𝑒 𝑏𝑢𝑠𝑖𝑛𝑒𝑠𝑠 𝑤𝑎𝑛𝑡𝑠 𝑡𝑜 𝑜𝑝𝑒𝑛 𝑎 𝑠𝑢𝑏𝑠𝑖𝑑𝑖𝑎𝑟𝑦 𝑖𝑛 𝐽𝑎𝑝𝑎𝑛 𝑎𝑛𝑑 𝑛𝑒𝑒𝑑𝑒𝑑 𝑙𝑒𝑔𝑎𝑙 𝑠𝑒𝑟𝑣𝑖𝑐𝑒𝑠 𝑓𝑟𝑜𝑚 𝑎 𝑙𝑜𝑐𝑎𝑙 𝑙𝑎𝑤𝑦𝑒𝑟. 𝐼𝑛𝑣𝑜𝑖𝑐𝑒𝑠 𝑎𝑟𝑒 𝑖𝑛 𝐽𝑃𝑌, 𝑤ℎ𝑖𝑙𝑒 𝑡ℎ𝑒 𝑏𝑢𝑠𝑖𝑛𝑒𝑠𝑠 𝑜𝑝𝑒𝑟𝑎𝑡𝑒𝑠 𝑖𝑛 𝑡ℎ𝑒 𝑙𝑜𝑐𝑎𝑙 𝑐𝑢𝑟𝑟𝑒𝑛𝑐𝑦. 𝘛𝘩𝘦 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴 𝘸𝘢𝘯𝘵𝘴 𝘵𝘰 𝘳𝘦𝘷𝘢𝘭𝘶𝘢𝘵𝘦 𝘵𝘳𝘢𝘯𝘴𝘢𝘤𝘵𝘪𝘰𝘯𝘴 𝘪𝘯 𝘑𝘗𝘠 𝘢𝘯𝘥 𝘢𝘤𝘤𝘰𝘶𝘯𝘵 𝘧𝘰𝘳 𝘦𝘹𝘤𝘩𝘢𝘯𝘨𝘦 𝘳𝘢𝘵𝘦 𝘷𝘢𝘳𝘪𝘢𝘯𝘤𝘦𝘴.

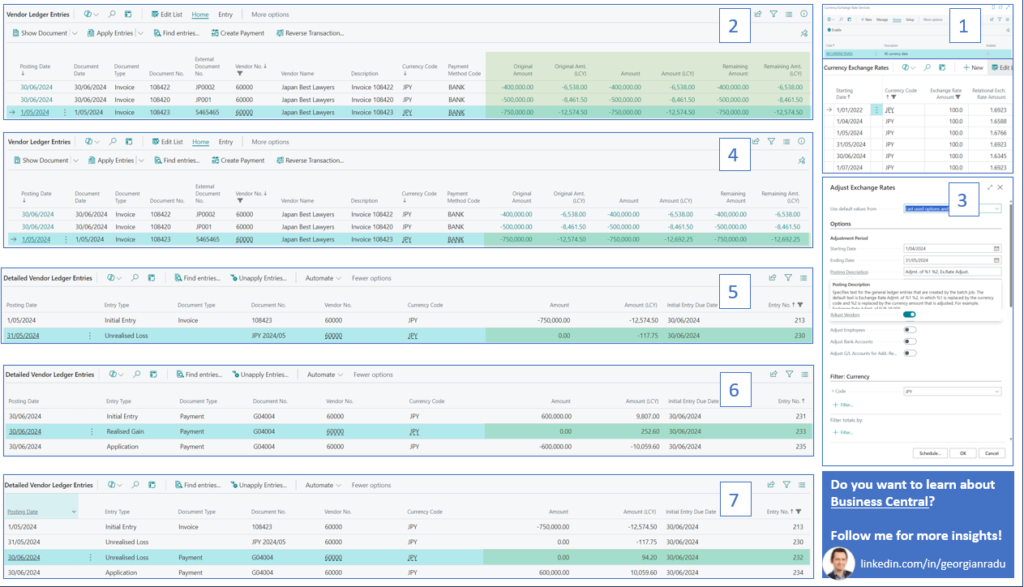

1️⃣ First, define the JPY as a currency and configure the currency exchance service. I used XE Currency Data extension, so all foreign exchange rates are synchronised seamlessly.

2️⃣ The business received 3 invoices in JPY from the lawyer in Japan, with the first registered on May, 1st. Each invoice has identical Original Amount (LCY and JPY), Amount (LCY & JPY and Remaining Amount (LCY & JPY).

3️⃣ At the end of May, run Adjust Exchange Rates to run the foreign currency revaluation process, so the value in local currency correctly reflects the value in JPY as per May, 31st exchange rate. Accounting is updated automatically at the completion of the Adjust Exchange Rates process.

4️⃣ After running Adjust Exchange Rates, the invoice was revaluated. Notice that while Original Amount (JPY) = Amount (JPY), now there is a difference between Original Amount (LCY) and Amount (LCY).

5️⃣ Because of a stronger JPY, the business registered an Unrealised Loss at the end of the month. That means, the business will have to pay more local currency (LCY), for the same value in JPY. Unrealised Loss = LCY 117.75

6️⃣ The business registers a partial payment on June 30 (JPY 600,000) and, because of the weaker JPY, the business pays only LCY 9,807, while

per the May 31st exchange rate, JPY 600,000 was equivalent to LCY 10,059.60. Hence the business registers a LCY 252.60 Realised Gain.

7️⃣ At the same time, the value of the invoice was also adjusted to consider the partial payment and shows a reversal of the initial Unrealised Loss of LCY 94.20.

Note: The invoice is still valued at the exchange rate from May 31st. Run Adjust Exchange Rates again to revaluate it based on the exchange rate from June 30th.